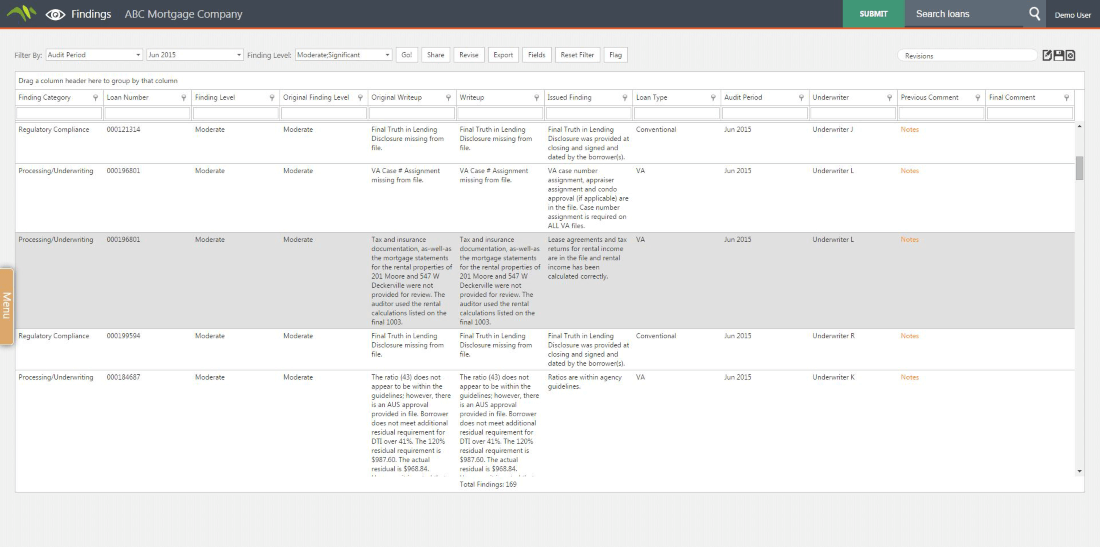

On the Findings page, mortgage compliance QC users can view their loans based on four levels; Insignificant, Moderate, Significant and Informational. Informational has the lowest audit score, while Significant has the highest. The Informational level contains audit comments from MetaSource Mortgage detailing information they found that was not worthy of a violation but something they felt the need to document.

There are primary and secondary filters on this page. The primary filter contains the following:

- Audit Period

- Audit Label

- Audit Type

- Finding Category

- Loan Type

- Investor

- Branch

Once a primary and secondary filter is selected, selecting GO will bring out all the findings for a specified time period. Instead of filtering through a massive PDF, the findings are returned instantly and organized and displayed in a way of your choosing.

Drag & Drop Capability

Drag and drop headings so you can rearrange columns. Add fields by selecting the “Fields” button in the top navigation and then dragging and dropping fields onto the Findings Page.

Exporting Data

Exporting to an Excel Spreadsheet for further manipulation is an option by clicking on the Excel button in the top navigation and save.

Sharing Information

Selecting a row, or loan number, will allow you to send a memo to an underwriter, branch, processes or, etc. for communication about the loan. The entire conversation is conducted, saved and viewable within the system. You can share multiple loans at the same time by holding down CTRL while selecting all of the loans you wish to discuss.

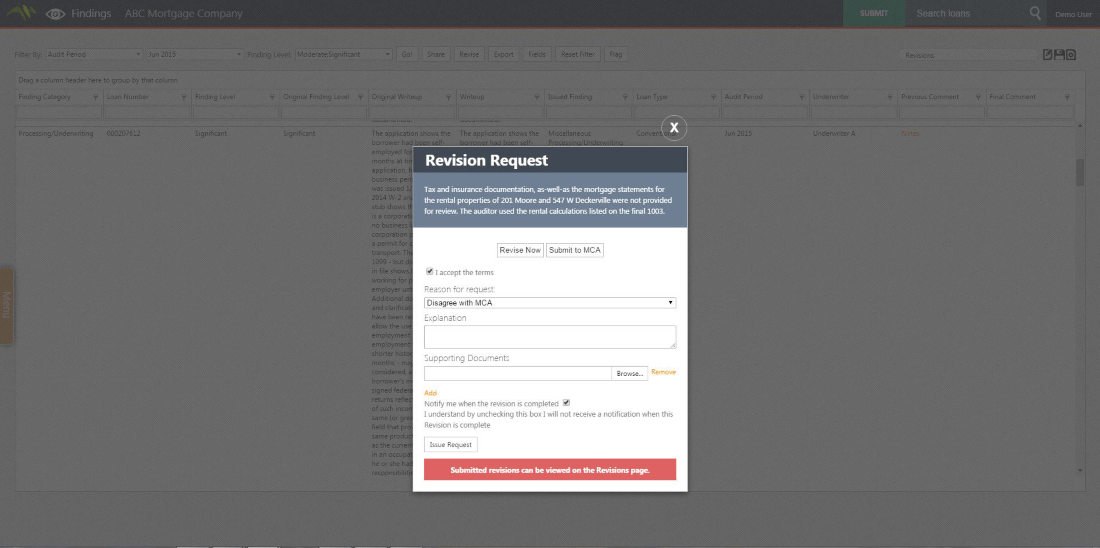

Revisions have become more important than they used to as they can have a direct impact on your defect rate. By clicking on the Revise button, you can either submit a request for revision to MetaSource or opt to make your own revisions, such as uploading missing documents, on your own immediately. MetaSource has a team of people which receives and processes these requests twenty-four hours a day with a completion time of ten business days.