There is a new requirement on the 4506-T Request for Transcript of Tax Return: the new form now includes a checkbox in the signature section that must be completed to generate a tax transcript.

Remember to Check the Box!

The new forms were required after March 1, 2016, so we want to make sure that you avoid having 4506-T forms being rejected.

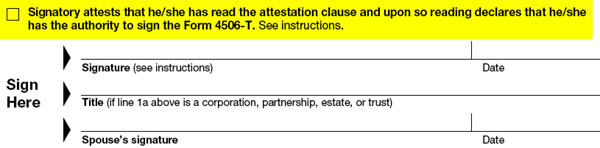

The portion of the form we’ve highlighted below is what needs to be checked and, of course, there also needs to be a signature, date, title and spouse’s signature and date if applicable:

Passive IRS Messaging

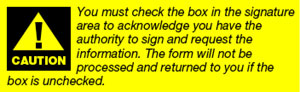

On page 2 of the 4506-T, you will see the following near the bottom of the second column that we’ve highlighted below: this serves as a reminder to check that important box so your form gets processed.

What to Do

Because the IRS has not effectively communicated this change to mortgage lenders, and because the notification is subtle (when not highlighted as it is here), we have seen many mortgage lenders submitting the old form. Your team may be able to get away with this for some amount of time longer, but there is no guarantee of that.

There’s also an electronic signature “gotcha”: if an electronic signature overlaps this checkbox section, these form submissions will also be rejected.

Thus, it’s time for you and your team to adhere to this new requirement or suffer the consequences.

Contact us to learn more about our 4506-T income verification services